Corporate Governance Structure

Corporate Governance Structure

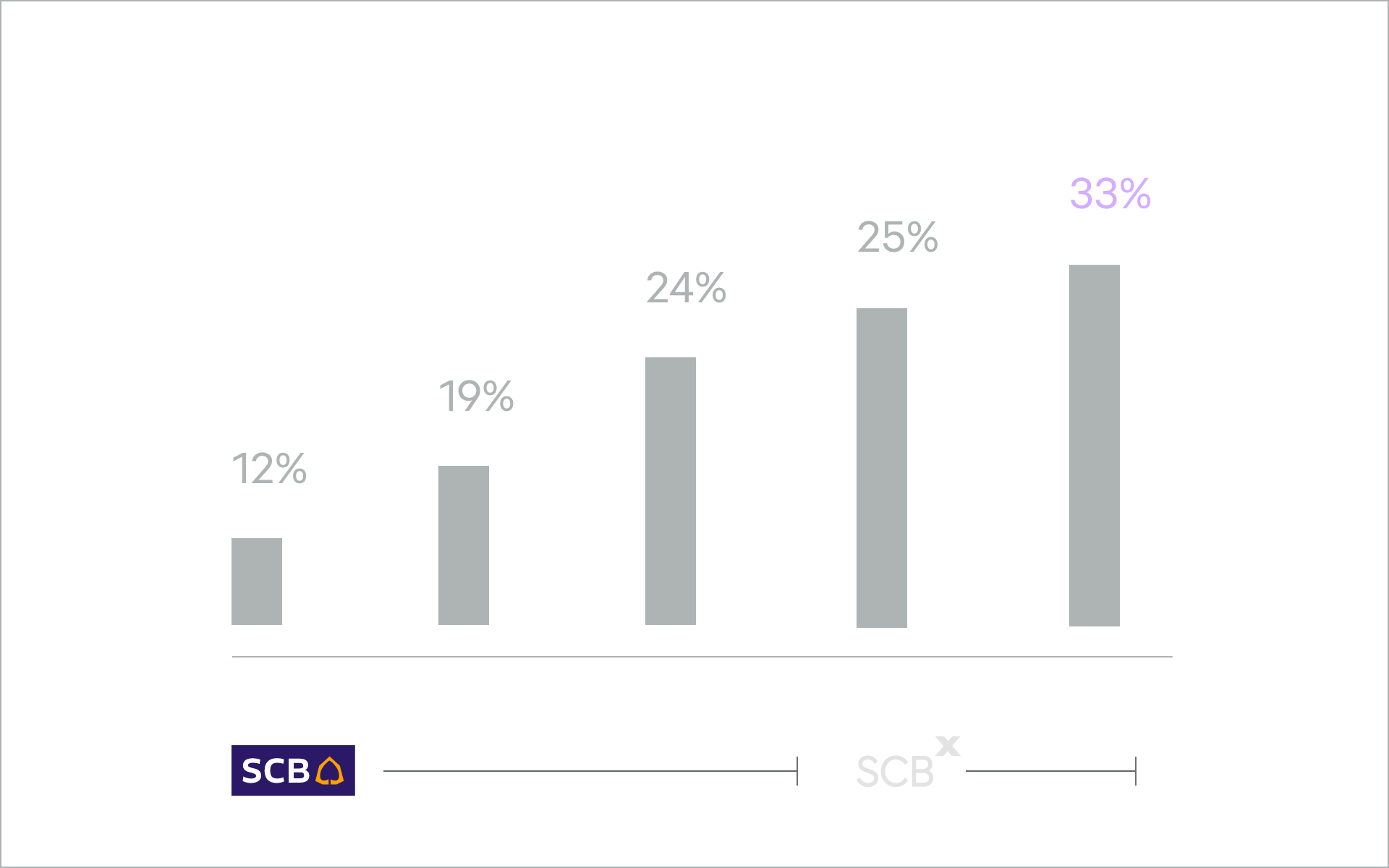

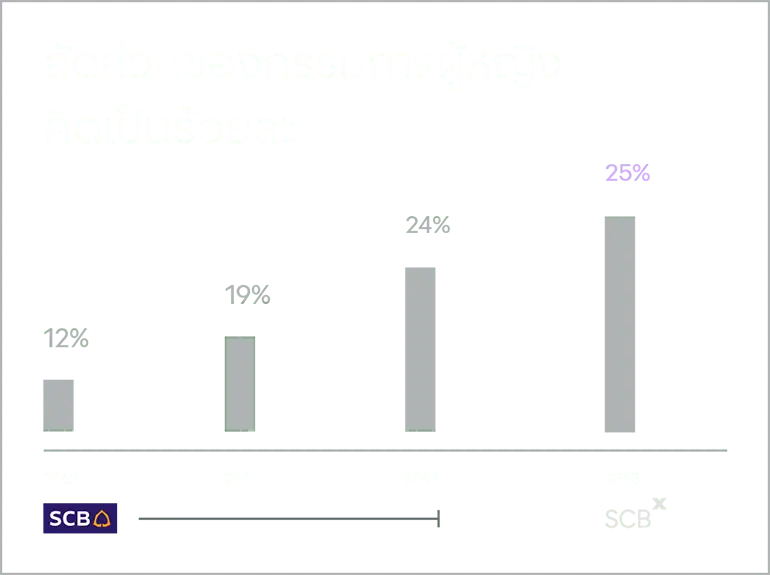

Fostering Diversity

SCBX seeks to foster diversity in terms of gender, race, nationality, age, educational background, professional experience, skills, knowledge, and other legal and societal aspects, which take into account social context and relevant laws by integrating diversity factors in director nomination criteria and selection processes to a greater breadth of perspectives and opinions, benefiting all stakeholders and driving sustainable growth.

Promoting Board Accountability

SCBX Board of Directors are accountable for the management of SCBX Group’s business operations. The Board’s decisions are to be independent and shall considers the highest benefits to SCBX Group, shareholders and all stakeholders. This is achieved through appropriate measures and practices to maintain transparency and accountability of all Board members.

SCBX encourages directors’ responsibility by specifying that Board meetings be organized at least six times per year and at least once every three months, in addition to requiring each director to attend at least 75% of the total number of meetings in a given year.

SCBX organizes an annual Board and Committee assessment which is divided into four parts, namely: 1. Board assessment, 2. Board committee assessment, and 3. Individual director assessment. Self-evaluations are also conducted by SCBX on an annual basis and by a third party once every three years or as deemed appropriate.

Additionally, SCBX strictly complies with relevant Thai laws and regulations, including disgorgement of benefits from directors and executives (Clawback), in compliance with Section 89/18 and 89/19 of the Securities and Exchange Act B.E. 1992. The sections stipulate that in an event that a director/executive performs or omits to perform duties as specified in the Section 89/7, the company has the right to disgorge any given benefits from responsible directors/executives. Moreover, SCBX complies with the Public Limited Company Act B.E. 2535, which stipulates, among other provisions, that directors may be held liable for any damages caused to the company if such damages result from their failure to comply with applicable laws, the company’s objectives, its articles of association, or resolutions passed by the shareholders’ meeting – particularly if such failure arises from dishonesty or negligence in protecting the company’s interests.