Retracing “SCBX” mothership’s 5-month transformation journey

Retracing "SCBX" mothership's 5-month transformation journey reveals three investment models to establish new enterprises focusing on financial technology and platforms to lay groundwork for unlimited future growth opportunities

After announcing a major transformation on 22 September 2021, approved by the Extraordinary General Meeting of Shareholders at the end of 2021 under the ‘mothership’ strategic move, the SCBX Group continues to embark on its journey, reflecting a new business model of building financial technology and platforms. The announcement came with the launch of new subsidiaries, including AISCB, SCB TechX, Alpha X, among others. and new investment models such as establishing venture capital funds focusing on investments in disruptive technology in the field of blockchain, digital assets, and financial and other technologies with high growth potential worldwide.

From “Upside Down” to “SCBX Mothership”

Realizing the digital disruption trend driving leading global companies to transform themselves to survive Siam Commercial Bank began its “Upside Down” strategic move some five years ago. Banks have to undergo major changes to compete with new players from tech companies, both domestically and internationally, to keep pace with changing consumer behavior. Those efforts led a “mothership” strategy to bring SCB group companies, comprising Siam Commercial Bank and subsidiaries, to focus on high-growth businesses and meet emerging demands with the goal of becoming a global and regional financial technology company with a value exceeding one trillion baht and a customer base of over 200 million people.

Spinning off new business through 3 investment models

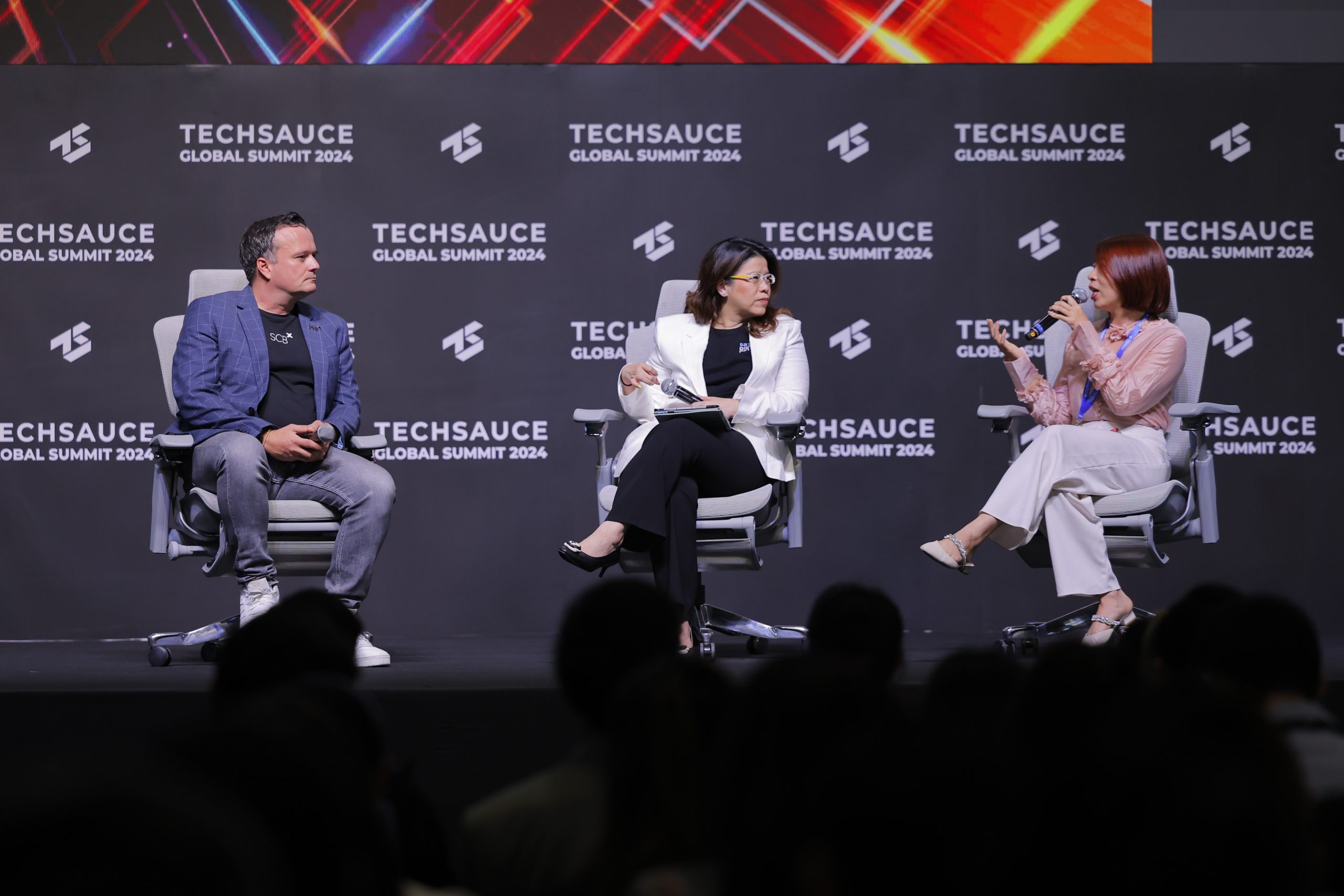

Siam Commercial Bank Chairman of the Executive Committee and CEO and SCBX PCL CEO Arthid Nanthawithaya said, “Over the past 5 months since the announcement of our important corporate strategy and the creation of the Group’s “SCBX mothership”, SCBX has explored new businesses with promising high-profit opportunities by adopting 3 different investing models:

- Companies established by SCBX to seek added value from personal finance business, focusing on high-growth businesses, such as Auto X for title loans and Card X for credit card and personal loan business.

- New companies or new businesses arising from investment in affiliated companies, such as establishing SCB 10X to handle platform or digital assets, Robinhood to operate a food delivery platform, and Token X to provide a full range of digital token business services.

- Collaborating with partners such as a joint-venture with AIS called AISCB to provide digital financial services; a joint-venture with Millennium Group Corporation (Asia) called Alpha X to provide hire purchase, leasing and refinancing services, supporting the premium-luxury segment; and SCB TechX, a joint venture company with Publicis Sapient to provide digital technology development and platform business, and more.”

“All three investment models will focus primarily on financial technology, platforms, and digital assets, as well as promising new businesses under close cooperation with regulators. These new businesses are not necessarily located in Thailand or Southeast Asia because digital technology enables SCB to reach target customers around the world.”

“Expanding into new businesses over the past five months, SCBX also acts as the “mothership” in charge of the Group’s business development and mergers and acquisitions in parallel with the SCB Group’s shareholding restructuring process. The next step will allow all shareholders to swap shares of Siam Commercial Bank for SCBX shares and to list SCBX shares on the Stock Exchange of Thailand, while delisting Siam Commercial Bank securities.”