At the Singapore FinTech Festival 2024, Token X Co., Ltd. (“Token X”), a subsidiary of Thailand’s leading financial technology conglomerate SCBX, emerged as a key player in a groundbreaking cross-border initiative for tokenized assets trading, offering unique insights into Southeast Asia’s evolving digital asset landscape.

The initiative, announced during a high-profile panel discussion, will connect regulated platforms across multiple jurisdictions to create a unified secondary market for tokenized assets, launching in Q1 2025. Token X’s participation highlights Thailand’s growing importance in the global digital asset ecosystem.

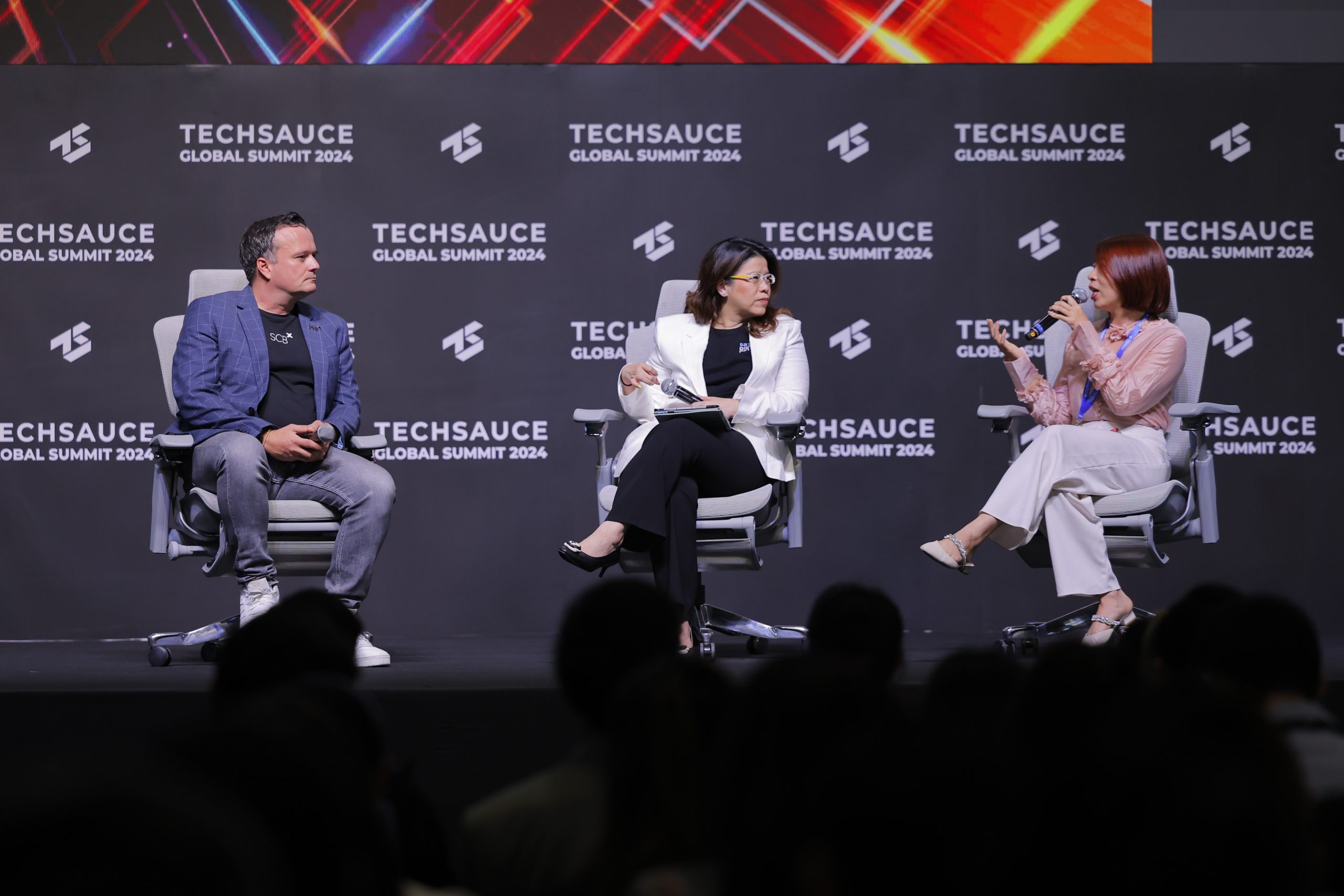

“The key challenge is the difference in regulations across countries,” explained Ms. Jittinun Chatsiharach, CEO of Token X. “In Thailand, for instance, we have a unique framework where tokenized real-world assets are classified as investment tokens rather than securities. Our focus is on bridging these regulatory gaps to create unified liquidity pools.”

Jittinun offered valuable insights into Thailand’s regulatory evolution, describing a journey that began with cryptocurrency trading and is now embracing broader digital asset innovations. “Initially, regulations were quite restricted, even prohibiting institutional investors from participating in crypto products,” she noted. “But as time passed, regulators began to understand the benefits of real-world asset tokenization and security tokens in bridging traditional and new financial worlds.”

While acknowledging the Thai Securities and Exchange Commission’s efforts to facilitate market development, Jittinun emphasized the need for coordinated support across regulatory bodies. “It’s not only the Thai SEC that needs to support this initiative. The Bank of Thailand and other regulators must also be involved for the market to achieve maximum adoption,” she explained.

The cross-border initiative, led by SBI Digital Markets, will connect Token X with other major platforms including Germany’s 21X and Korea’s Kyobo Securities. “We’re a blockchain-agnostic hub that will facilitate the flow of tokenized assets across our network,” said Winston Quek, CEO of SBI Digital Markets, explaining how the system will allow assets listed on one platform to access liquidity from multiple exchanges.

This collaboration is timely for Thailand’s evolving digital asset market. Jittinun highlighted the proactive and supportive approach of Thai regulators who are “extremely accommodating and friendly towards change”.

The initiative addresses a critical gap in the tokenization landscape. While various assets from fixed income to commodities have been tokenized, most remain one-off products without sustainable secondary markets. The new network aims to solve this by connecting multiple regulated platforms across jurisdictions.

For Thailand, participation in this network represents a significant step forward in integrating its digital asset market with global financial infrastructure. Token X’s involvement could help establish Thailand as a key hub in the growing tokenized asset ecosystem, while navigating the careful balance between innovation and regulatory compliance that has characterized the Thai market’s development.

“The market is fragmented,” Jittinun concluded, emphasizing the need for collaboration. “We need to work together to push the market forward.” This initiative represents a significant step toward that goal, potentially establishing a new paradigm for cross-border trading of tokenized assets.

Reported from the Singapore FinTech Festival 2024