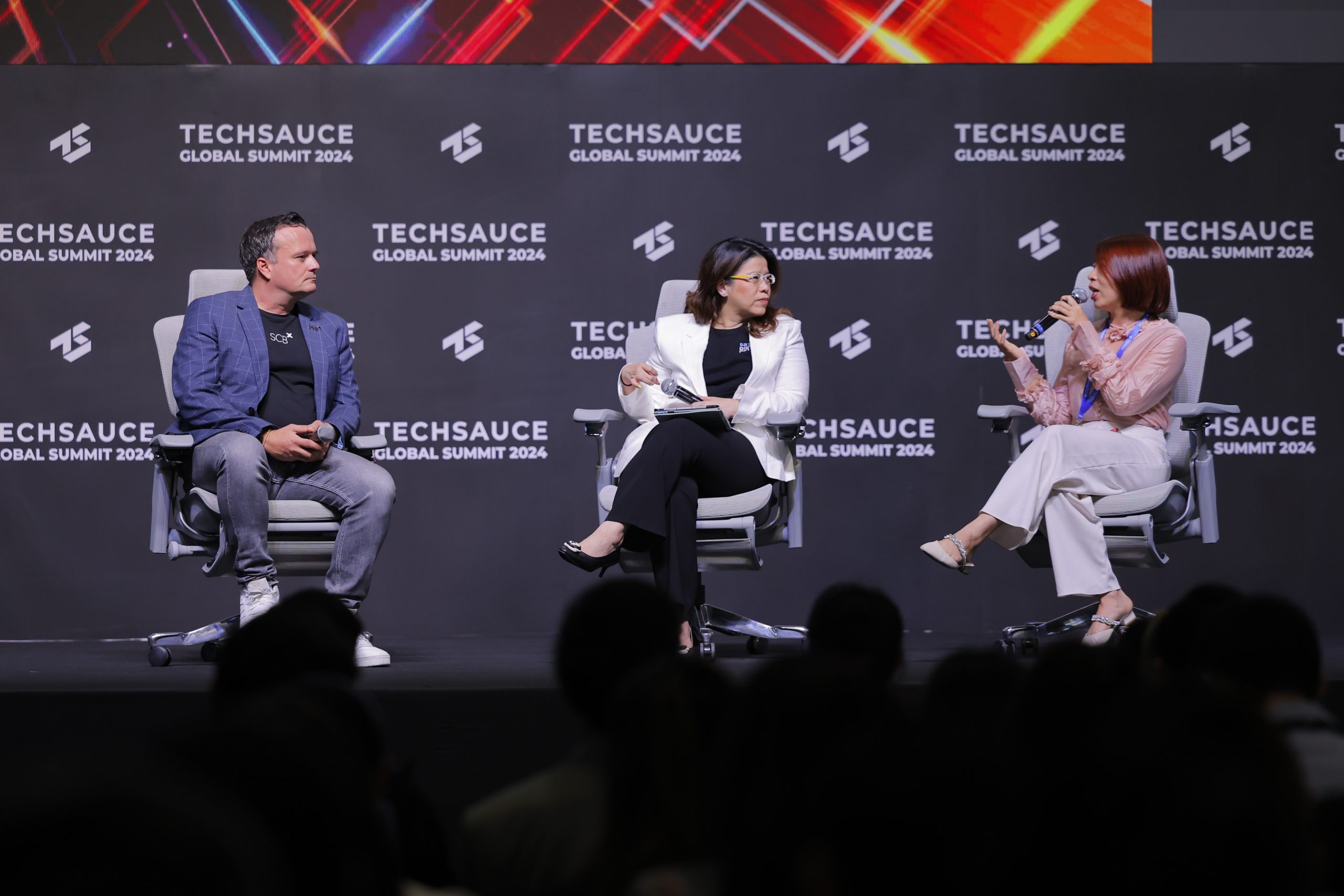

Bangkok, Thailand – At the recent World Economic Forum (WEF) ASEAN meeting, industry leaders from financial services shared their strategies and challenges in leveraging AI, highlighting significant investments and diverse applications across the sector. The conversation underscored the transformative potential of AI, with a reported $35 billion invested in AI technology last year alone, signaling its critical role in driving innovation and efficiency in financial services.

- Comprehensive AI Integration: Financial institutions are using AI to maximize the technology’s potential, not only for internal efficiencies but also to foster industry-wide collaborations and engage with regulators.

- Customer-Centric Innovation: Companies like Ascend Money and Ant Group prioritize using AI to enhance customer experiences, from personalized financial services to advanced healthcare solutions.

- Building AI Capabilities and Literacy: Organizations such as SCBX emphasize the importance of developing in-house AI capabilities and ensuring employees are well-versed in AI applications to drive innovation and adoption.

Big Picture and Trends

The financial industry rapidly integrates AI technologies to enhance data analytics, improve customer experiences, and strengthen risk management. SCBX, The Bank of Thailand, Ant Group, Ascend Money, and Kasikorn Bank are at the forefront of this wave, each adopting unique approaches to incorporate AI into their operations. This trend is not limited to internal processes but extends to industry-wide collaborations and regulatory engagements, indicating a comprehensive shift toward AI-driven financial ecosystems.

Diverse Strategies and Challenges

Bank of Thailand: Dr. Daranee Saeju, Assistant Governor, Payment Systems Policy and Financial Consumer Protection Group, Bank of Thailand, emphasized the central bank’s dual-track AI strategy: internal enhancement and external collaboration. Internally, AI is utilized for data analytics, social media sentiment analysis, and supervisory functions. The central bank’s AI task force focuses on integrating AI into various central banking functions while ensuring data confidentiality and proper safeguards. Externally, the Bank of Thailand collaborates with the financial sector through an AI in finance working group, aiming to publish a consultation paper on AI use cases by year-end, focusing on fraud detection and anomaly identification.

SCBX: Dr. Arak Sutivong, Deputy Chief Executive Officer of SCB X Public Company and Chief Executive Officer of SCB DataX Co., Ltd., discussed SCBX’s vision of becoming an AI-first organization, emphasizing the democratization of AI. SCBX, Thailand’s leading financial technology business group, separates its AI initiatives into deep AI development and broad AI adoption. The group has invested in building advanced AI capabilities, such as developing a Thai foundation model and establishing DataX for data monetization. SCBX also focuses on enhancing AI literacy among its employees to ensure broad adoption and integration of AI into daily operations.

Ant Group: Leiming Chen, Chief Sustainability Officer, Ant International, and SVP, Ant Group, highlighted Ant Group’s AI-first strategy, focusing on lifestyle services, financial services, and healthcare. Ant Group leverages its vast user base and data to drive innovation in these areas. The group addresses risk management and fraud detection challenges by developing advanced AI applications. Additionally, Ant Group is investing in green computing technologies to balance computing power and energy efficiency.

Ascend Money: Ms. Monsinee Nakapanant, Co-President and Group Chief Operating Officer of Ascend Money Co Ltd, outlined Ascend Money’s mission-driven approach to AI, aiming to enhance financial inclusion. Ascend Money uses AI to personalize financial services, optimize credit models, and recommend suitable products to users. The company also invests in fraud detection and security, using AI to analyze transactions and onboard users safely. Ascend Money’s strategy emphasizes customer-centric innovation, ensuring technology addresses user pain points.

Kasikorn Bank: Mr Krating Poonpol, Group Chief Technology Officer, Kasikorn Bank Technology Group, described Kasikorn Bank’s holistic AI-driven transformation. The bank focuses on data-driven and automation-first transformations, implementing predictive AI and developing in-house AI capabilities. Kasikorn Bank’s AI initiatives span various areas, including financial literacy, customer service, and security. The bank emphasizes AI literacy among employees and collaborates with global experts to stay at the forefront of AI advancements.

Deep Dive into SCBX’s AI Strategy

SCBX’s approach to AI is both ambitious and multifaceted, encompassing a wide range of innovative strategies and initiatives, including:

- Vision and Integration: SCBX’s AI-first vision entails integrating AI into every aspect of its operations, from underwriting and credit scoring to customer service and process automation. This proactive approach ensures that AI is not an afterthought but a core component of their strategy.

- Deep AI Development: SCBX is investing heavily in developing advanced AI capabilities. This includes setting up a dedicated R&D unit focused on creating a Thai foundation model, which is crucial given the low presence of the Thai language on the internet. This initiative aims to improve AI’s applicability and effectiveness in the Thai context.

- Broad AI Adoption: To ensure widespread AI literacy, SCBX has implemented training programs for all employees, encouraging them to identify and develop AI use cases within their roles. This bottom-up approach fosters innovation and ensures that AI benefits are realized across the organization.

- DataX and Venture Cap Investments: SCBX’s DataX unit serves as the group’s data foundation, enabling data harnessing and monetization. Additionally, its venture capital fund invests in AI startups, ensuring they stay at the forefront of AI innovation.

- Practical Applications and Benefits: AI applications at SCBX include credit underwriting, which has improved financial inclusion by allowing the bank to understand customers better and offer more tailored services. Other initiatives include process automation and the development of AI-driven chatbots to enhance customer service.

Challenges and Opportunities

While AI presents numerous opportunities, the panelists acknowledged several challenges:

- Regulation and Security: A significant concern is ensuring that AI applications comply with regulatory requirements and maintain data security. Collaboration with regulators is crucial to developing effective risk management and fraud detection systems.

- Computing Power and Energy Efficiency: Balancing AI’s computational demands with energy efficiency is a critical issue. Companies like Ant Group are focusing on green computing to address this challenge.

- AI Literacy and Workforce Adaptation: Training employees to understand and utilize AI effectively is essential for successful integration. Companies must invest in education and development programs to build a workforce capable of leveraging AI’s full potential.

The discussions at the World Economic Forum highlight a pivotal moment in financial services, where AI is becoming integral to operational strategies and customer engagement. As financial institutions navigate the challenges and opportunities of AI, their collective efforts promise to reshape the industry’s future, driving efficiency, inclusivity, and innovation.