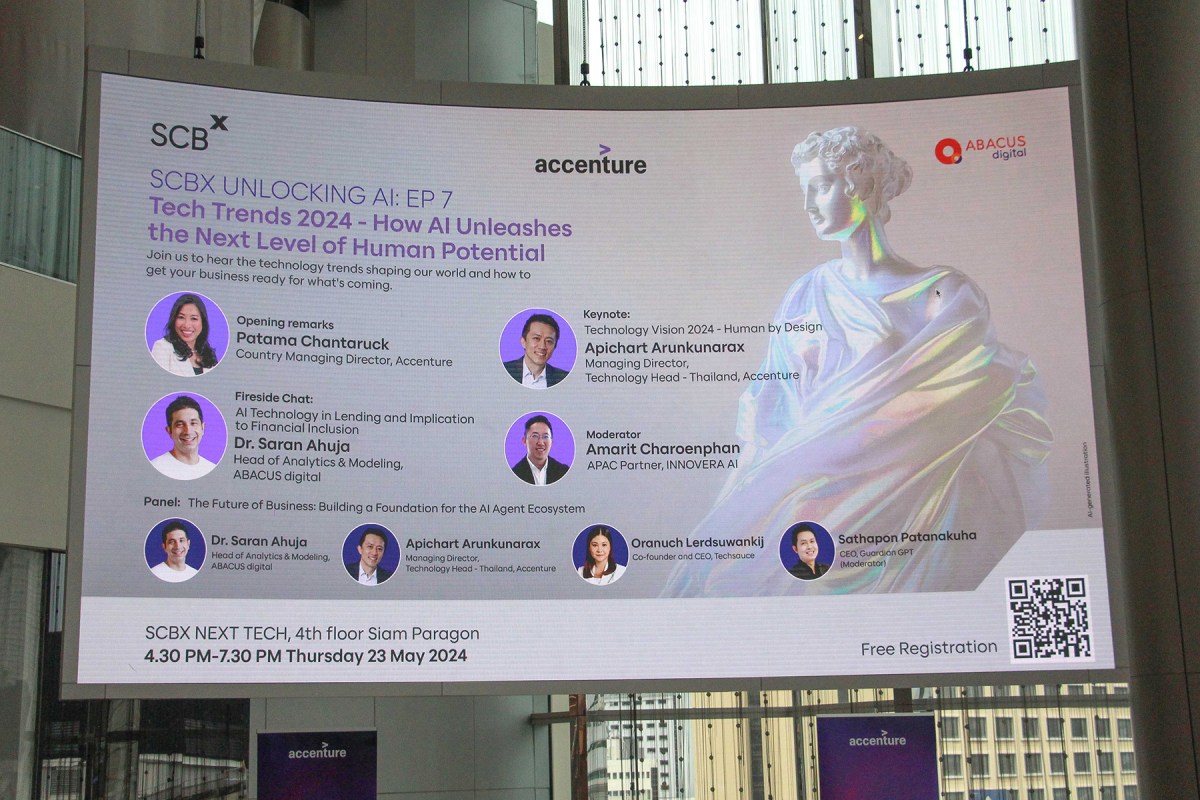

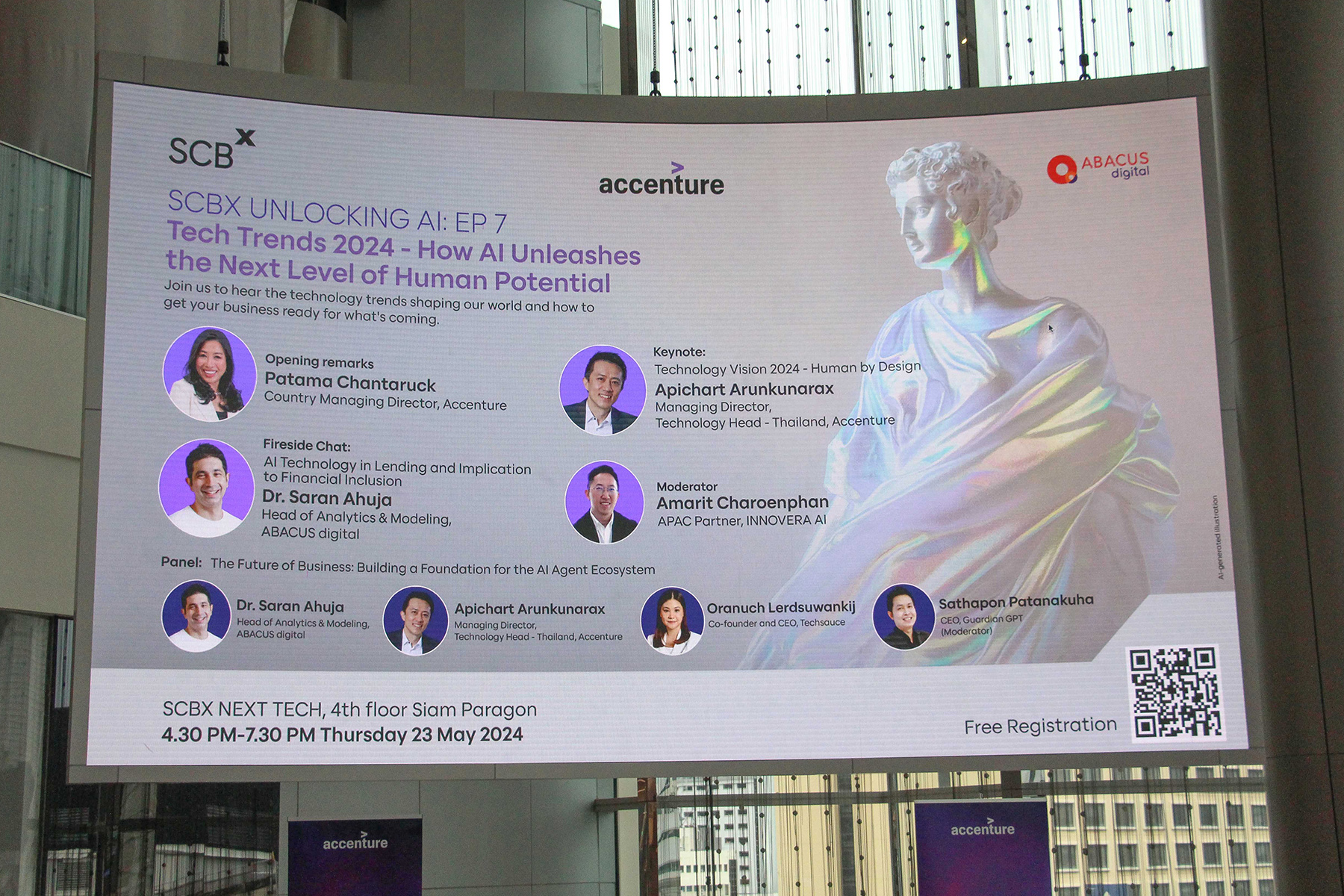

In recent fireside chat titled AI Technology in Lending and Implication to Financial Inclusion, held at SCBX Next Tech as part of the SCBX Unlocking AI: EP 7 Tech Trends 2024 – How AI Unleashes the Next Level of Human Potential event, industry experts delved into the transformative potential of AI in revolutionizing financial services. The discussion featured Dr. Saran Ahuja, Head of Analytics & Modeling at ABACUS digital, moderated by Amarit Charoenphan, APAC Partner at INNOVERA AI.

- AI Enhances Financial Inclusion: AI technology lowers operational and risk costs, enabling lenders to serve lower-income segments and addressing financial exclusion for self-employed, freelance, and lower-salaried individuals.

- Streamlined Lending Processes: AI improves lending through applications like document verification, fraud detection, income estimation, risk assessment, and collections, making financial services more efficient and accessible.

- Addressing Infrastructure Challenges in Thailand: Despite challenges with Thailand’s data infrastructure, government initiatives promoting open data are promising. Strategic partnerships and improved data methods are crucial for enhancing financial inclusion.

The Financial Inclusion Challenge

The conversation began by addressing a persistent global issue: financial inclusion. Despite widespread access to banking in countries like Thailand, credit accessibility remains severely limited. Traditional lending systems often fail to cater to lower-income segments, a problem rooted in the high costs associated with risk assessment and operations.

Dr. Saran explained, “Lenders face a delicate balancing act between managing risk costs and operational costs. Serving higher-risk, lower-income borrowers typically incurs higher costs either through intensive evaluation processes or by accepting increased risk. Consequently, traditional lenders prefer to focus on easily evaluable segments like salaried employees, leaving out self-employed, freelance, and lower-salaried individuals.”

The Digital Lending Shift

The advent of digital lending has introduced both opportunities and challenges. While it automates processes and reduces human judgment errors, it also amplifies risks due to the volume of transactions and potential for mistakes. “Digital lending can scale rapidly, but with this scalability comes a heightened risk of errors that can be costly,” Dr. Saran noted.

AI: The Game-Changer for Financial Inclusion

AI technology emerges as a powerful solution to these challenges. By lowering both operational and risk costs, AI can significantly expand access to financial services. Dr. Saran highlighted how AI enables automation at various stages of the lending process, from application and customer support to KYC verification and collections.

“AI leverages data for predictive and optimization purposes in areas such as risk assessment, fraud detection, income estimation, and collection. This results in a lower cost structure and better risk management, enabling lenders to serve lower-income segments more effectively,” he said.

Key Applications of AI in Lending

During the chat, Dr. Ahuja demystified the practical applications of AI in lending:

- Document Verification: Automating the verification process to reduce errors and speed up approvals.

- Fraud Detection: Using AI algorithms to detect and prevent fraudulent activities.

- Income Estimation: Accurately estimating an applicant’s income using diverse data sources.

- Risk Assessment: Enhancing risk models with AI to make more informed lending decisions.

- Collection: Optimizing the collection process to improve recovery rates.

Overcoming Challenges in Thailand

The discussion also touched on the specific challenges of implementing AI-driven lending solutions in Thailand. A significant hurdle is the data infrastructure, which is still developing but progressing positively with government initiatives promoting open data. “Improving data infrastructure is crucial for the feasibility of AI lending solutions. High data checking costs can eat into margins, especially in lower loan sizes and approval segments,” Dr. Saran explained.

Building an Inclusive Future

To build a more inclusive financial system, enhancing data infrastructure is essential. Dr. Ahuja advocated for strategic partnerships, such as collaborating with utility companies and leveraging government open data initiatives. “At ABACUS digital, we are committed to improving data gathering and establishing partnerships to democratize data access, thus facilitating broader financial inclusion,” he emphasized.

Competitive Edge of ABACUS digital

In a crowded AI lending market, ABACUS digital differentiates itself through its robust data analytics capabilities and strategic partnerships. Dr. Saran highlighted Abacus’ strengths, including their advanced AI models and comprehensive approach to leveraging data, which set them apart from competitors.

The fireside chat concluded on a positive note, underscoring the potential of AI to address financial inclusion challenges effectively. As Dr. Saran summed up that financial inclusion is a solvable problem, and AI is a powerful tool in achieving this goal. The future of AI-powered lending innovations is bright, promising a more inclusive financial system for all.