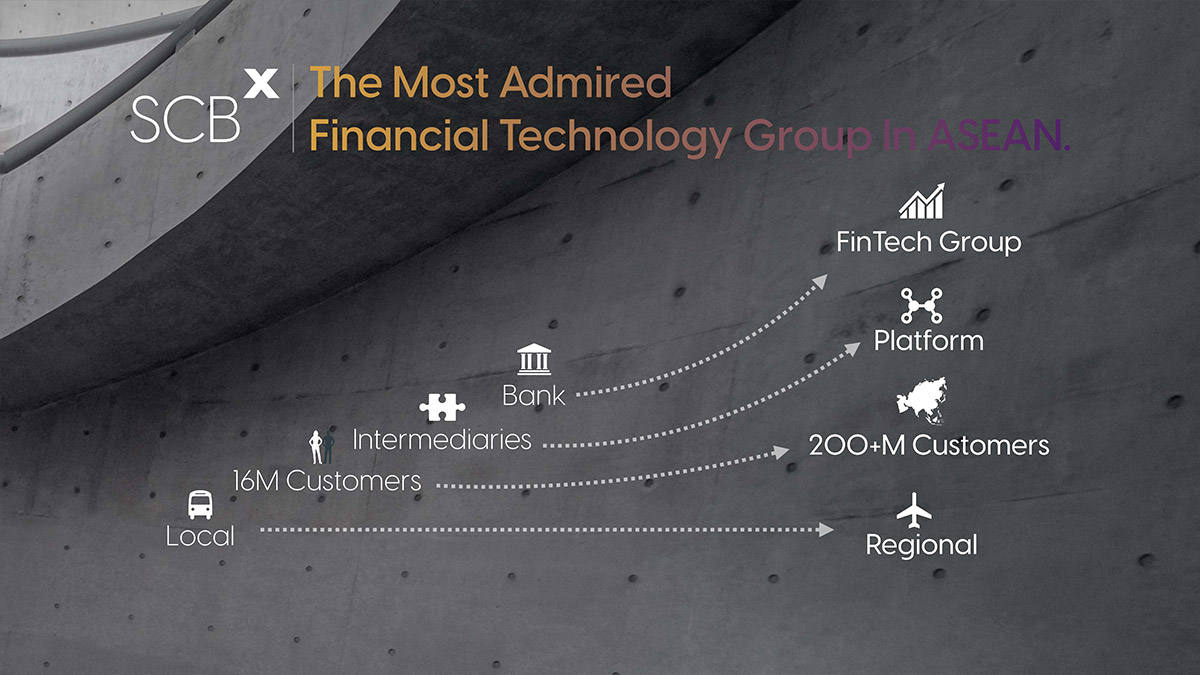

SCB’s latest reorganization made headlines both inside and outside the banking industry after it announced its SCBX mothership strategic plan to spin-off companies in order to enter new frontiers of doing business and embracing its digital assets as a secret weapon for regional expansion. Siam Commercial Bank CEO and Chairman of the Executive Committee Arthid Nanthawithaya shared his vision as the SCBX mothership captain, synergizing collaboration across every sector to make the first move in creating infrastructure for small players in the digital era and driving the Thai economy to be stronger and faster so that it is ready to enter a new era of global competition.

A prequel

The mission to build the SCBX mothership started at the end of 2019 when Arthid Nanthawithaya received the green light from the Board of Directors. He brought the matter into a discussion with regulators, initiating deals, seeking partners, and making necessary preparations. It was 22 September 2021 when he officially announced the news about the mission to launch the SCBX mothership. Today, he tells the story about the beginning of what has become a mission to explore new frontiers beyond banking. “The day I took the position in 2018 I didn’t know anything about technology. I was just a technology user, and as a CEO I still had a lot to learn. I took a trip to meet with big tech companies and hear their opinions. The more I listened, the more, I feared. I asked myself whether we will survive. I finally resolved that it was time to invest more in technology.”

From ignorance to awakening and experimentation

To turn the Bank into a tech company, I started by setting up a small unit to change people’s mindsets, the procurement process, in-house software, investment, and so forth. Around 5-6 years ago I suggested to the Board that the Bank should allocate about 1% of its profits on R&D. Some projects failed, but others like Digital Ventures succeeded. Digital Ventures became the SCB10X we know today.

Building collaboration for the future.

Arthid continued, “Our vision arose from wanting to create a sustainable organization for the next generation and for the future. We can no longer apply the same formula for success. When everyone knows what to do, they are ready to listen. Our proposal caught the attention of regulators, and they finally agreed that what we proposed made sense. It took almost two years to get everyone involved in building and owning this project. Everyone was excited and wanted to see the organization moving in that direction.”

Don’t put difficult factors in the equation.

When asked about techniques for creating equations of change, Arthid said, “I would like to share with everyone that if you think things are going to be difficult, they will be. If we take action, listen to comments, and let everyone take ownership, they will be ready to compromise and step back. These are the elements that will allow us to move forward. Difficult factors are no longer in the equation. We’ll think about the next step when it’s time to take the next step. Making everyone feel that their opinions count is the most important part of the whole story. Really important.”

Growth Strategies Based on Growth Business of the Future

Entering into an industry that banks are not good at, even though it’s considered a blue ocean, is not an easy task. There are already small but keen players both at home and abroad. Arthid talked about his tactics, “In this world, there are lots of talented people in new areas. In developed countries such as the US, big tech companies have to compete with startups. If they don’t have capable people, they won’t be able to compete with startups.

A founder can excel to a certain point, but when an organization gets bigger, they need good people. I call these talented people Tao Kae Noi or young entrepreneurs. We have to clone more of these young Tao Kae Noi in the hi-tech era. Historically all we’ve done is banking, and as bankers, we shouldn’t be ashamed to admit this fact. I was one of them. All we’ve learned and done is banking, so we can’t turn into technologists overnight. However, we have to realize our limits and look for a new formula for success. How can we attract Tao Kae Noi?”

Creating a new generation of tech-savvy young entrepreneurs

Arthid continued, “These young tech entrepreneurs must be a part of our success. If we look for employees, we’ll get a different type of people and there is no way to bring tech workers to compete with startups. We must create tech-savvy young business owners and design decision-making processes enabling them to take ownership. CEOs of group companies will not report to me, but to their own Board of Directors.

Everyone has a goal to take their companies to IPOs and create a future for their organizations. The mothership is responsible for providing resources and sending representatives to serve on the company Board. I have a duty to support them, and my main job is to continue building ventures, new companies, and seeking new partners. So, I wouldn’t call SCBX a holding company or bookkeeper.”

Key Success Factors for Winning in Unfamiliar Contexts

“I think that Tao Kae Noi will be the driving force in building capabilities in technology and data in each venture or company. Tech X and Data X will provide the support necessary for each Tao Kae Noi. This is the formula that I have put in place.

The rest will be the role of the mothership. Our biggest challenge is to enter regional or international markets, not as a commercial bank, but in different contexts such as platforms.” Arthid also mentioned network effects and “Winner Takes All” concepts, saying that “Building a winning platform in Thailand alone is not enough. With customer scale leading big data and insights to create something different and competitive, we cannot remain complacent as local players.”

A big player to help develop ecosystems for small players to grow

The intention of establishing SCBX was to become “an infrastructure enabling small startups seeking know-how and funding and let them become stable and efficient global players in digital assets. It is our intention to ready startups for the world of digital assets in the regional or global arenas.

This news raised eyebrows as some people might not agree, fearing unfair competition when two giant companies merged. When big players invest, what venture capitalists need is a return in the form of profits or resources to help better their companies with technology. Small players or startups are worried that their existing spaces are tough, and they fear more players coming in from abroad, leaving no more space for small companies. What will they gain from these spin-off companies?

To answer the question, Arthid said, “There are good examples in the US. Big corporations like Amazon, Microsoft, and Google joined with startups to create ecosystems through investment. I believe in this model, so it’s the format adopted by SCBX. One of the approaches is focusing on joint ventures. JVs give us the opportunity to diversify and work with different people, not necessarily with big companies. We don’t need to own 80% of a company and leave them with a small portion. Only 50% would be fine. We want to share. For example, when launching the food delivery platform Robinhood we partnered with restaurants. In the future, we will partner with hotels to create and operate an Online Travel Agency (OTA).

It doesn’t mean that we want only big hotels. As with Robinhood, we even started with small shops. That’s our philosophy. We don’t want to take everything on the board. We’ve positioned ourselves in a way that we generate benefits and create an ecosystem where everyone can compete. We don’t want to be viewed as a competitor; we just want to make Thailand run faster. Having big players is not a bad thing, and the fact that the country has only small players won’t make us competitive with the world. It is the big players that connect and build the groundwork and provide ecosystems so that small players can compete and keep pace with the world. That is the intention of SCBX.”

Shifting from intermediary to platform

The arrival of technology has disrupted intermediary businesses and will eventually swallow them up. When SCB was contemplating a new platform, the question was, which type of platform? Arthid said, “It’s important that we have a new foundation that allows us to move faster, to be more efficient, and more innovative, with technical support and customers set as the target. I don’t know what exactly must be done. But we have the foundation, software, a concept of driving young entrepreneurs, the mothership, and ample capital from our cash cow business. There has never been any startup starting with a cash cow. We must turn our weaknesses into strengths. We shouldn’t look at what other people have, and we don’t have. We have what others don’t have, and together we’ll create what we don’t have. I think that’s the solution.”

What do ordinary people, businesses, and society gain from this deal?

“We want to bring the cost of access to finance down with increasing efficiency by adopting technology. That is our mission during the transition period. Whether small, medium, or large enterprises, they need to adapt, especially the real sector. They need to adjust their ways of doing businesses affected by new technologies to the point that their business processes and models must be revamped to better respond to the competition. We are supporting the bank indirectly because we’ll leave the bank carrying on with the cash cow business. But what we are doing on the other side is not just personal or title loans, because several companies are already doing that. We have been investing for many years and creating blockchains for the business sector, not just one small company.”

Arthid provided an example of collaborating with Samitivej Hospital in creating the SkinX telemedicine application. “We’ve learned a lot. We have reached the point where we are ready to invite partners to expand. These are the intentions that I believe will benefit the business sector and the Thai people. We can’t take care of everything, but I can say that it is our mission. We want to bring benefits and rewards to society.”

What about bank employees?

Arthid said, “The intention of the SCB Board and management of SCB which will become SCBX is to do whatever it takes to keep an organization with a long history of 115 years remaining as a sustainable organization, braving coming changes and risks and better responding to society and customers in various aspects. We don’t want to achieve one trillion assets. However, it provides us with the power to drive the organization to a point where the Board of Directors and management are happy with what we’ve achieved. We want to see the entire SCBX becoming an organization with a new foundation, meeting the expectations of society, businesses, and customers while creating benefits and serving as a pillar driving the nation’s economy and society. We want to transition into a new era driven by technology or digital assets when it comes to financing. We want to play a part in driving Thai society to be able to compete in the global arena. These are our intentions.”

For employees, Arthid said, “Those in the X group will work under an intense environment, while those of the Bank will continue to drive their organization and business. The organization will be smaller, but there will be no layoffs. We’ll implement an early retirement scheme, as every year there will be new generations coming in and out. Without new recruitment, our organization is getting smaller. To do all this, we need to train, relocate, and redeploy people, and recruit new people when necessary. It may not be the most efficient way to do things, but we will be better off in the long run. We have to remain balanced, and I believe this will be the best way forward for the organization and for society.”

Definition of Leadership and Humbleness

When asked about the recipe for success, Arthid said, “What I always tell every team is that a humble mindset is very important. If people start to think they are better than others they will view others as a burden. But everyone is smart in their own way. If you are humble enough, listen enough, and are open to suggestions you will be better off. Others will become your partners. You’ll only win. This is important.”

From the role of a bank executive to the captain of the mothership, Arthid has had to adjust his roles and views. “I listen more. I am learning from those who will become Tao Kae Noi. Train yourself to be clear about your role and learn to accept mistakes and make your own decisions. It’s a new paradigm. Previously, every finger was pointing in your direction telling you the way to go. Now, it’s time to actually look from afar and tell yourself where you need to go and what your role will be. We will allow others to make decisions and make them stronger.”

SCBX’s important journey involves not only a restructuring process but an ambition to expand to the regional level. However, it is the beginning of a new dawn for Thai conglomerates with a business model readying itself to surf coming technology waves. It will provide a strong pillar supporting businesses and society and enable them to be more resilient against the borderless competition in order to maintain the nation’s economic system and leave space for Thais to conduct business steadily, fairly, and sustainably in the global arena.

Source: Interview with Arthid Nanthawithaya, CEO and Chairman of the Executive Committee, Siam Commercial Bank on The Secret Sauce on 16 October 2021