Sustainable Investment

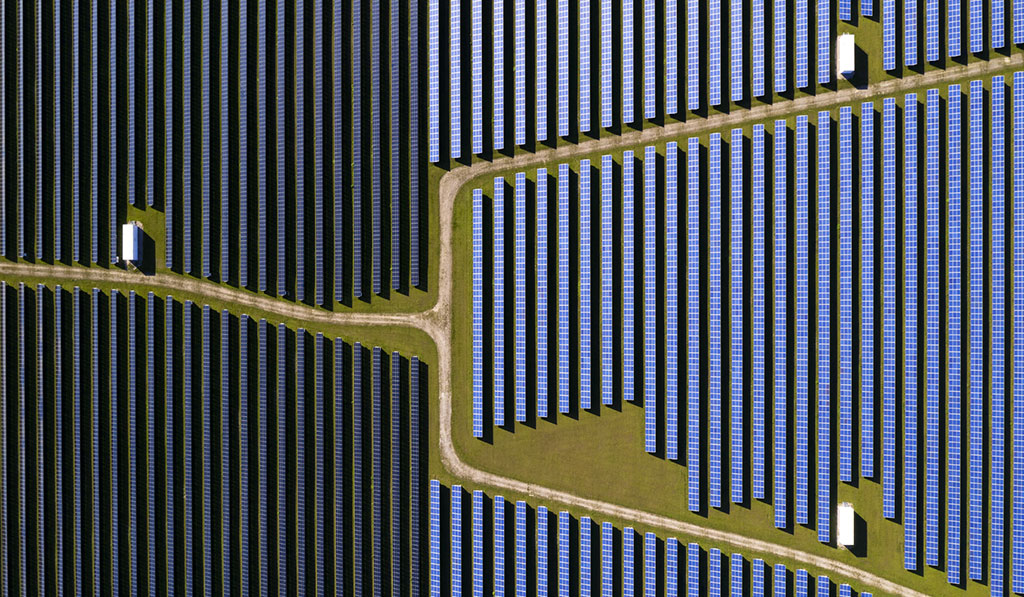

SCBX firmly believes that integrating ESG consideration into its underwriting process will help improve decision-making on investment advisory, increase risk-adjusted returns in the long term, and also prevent and alleviate negative externalities while fostering beneficial impacts on society.

SCBX subsidiary, SCB, promotes sustainable investment in adherence to the Responsible Investment Advisory Policy, which covers investment advisory services for all asset classes. Wealth management personnel are professionally trained and adept at communicating and providing investment advisories that are well-suited to each client’s demand. At the same time, SCB Asset Management has offered a range of investment funds that employ ESG criteria including ESG Thematic Fund and ESG Fund.

Sustainable Investment

SCBX firmly believes that integrating ESG consideration into its underwriting process will help improve decision-making on investment advisory, increase risk-adjusted returns in the long term, and also prevent and alleviate negative externalities while fostering beneficial impacts to the society.

SCBX subsidiary, SCB, promotes sustainable investment in adherence to the Responsible Investment Advisory Policy, which covers investment advisory services for all asset classes. Wealth management personnel are professionally trained and adept at communicating and providing investment advisory that are well-suited to each client’s demand. At the same time, SCB Asset Management has offered a range of investment funds that employ ESG criteria including ESG Thematic Fund and ESG Fund.